Digital technologies have the potential to help close the gaps in financial inclusion, in particular through mobile banking.

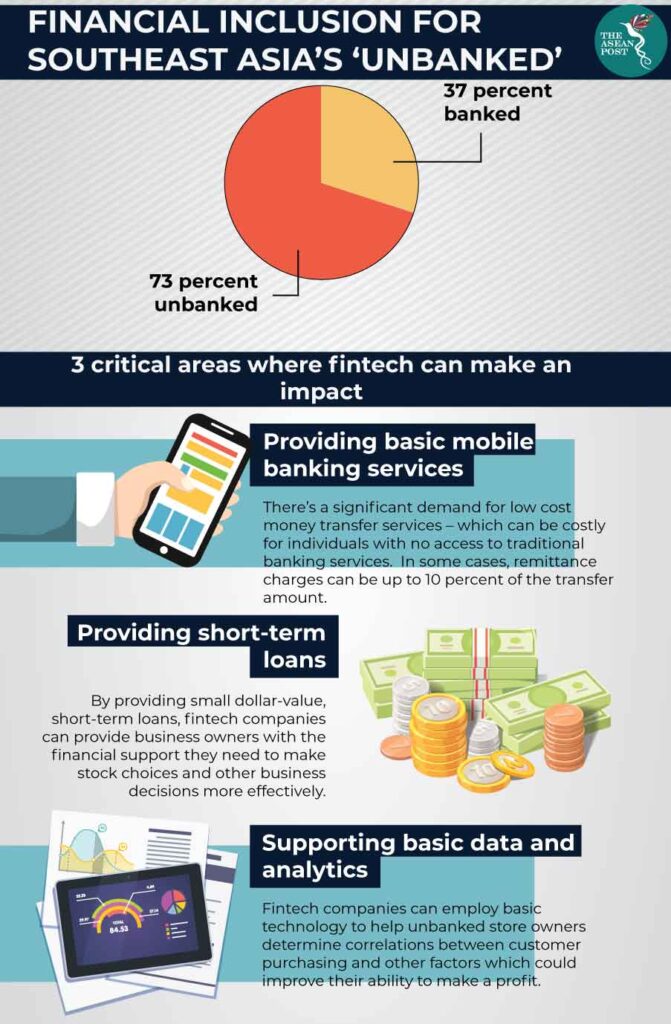

You probably already know that the six largest Southeast Asian countries represent one of the world’s largest and fastest-growing regions, with a population of 668 million and a thriving GDP of US$ 4.7 trillion by 2025. What you probably don’t know is that only 18 percent of its adult population using bank account to receive wages and only 11 per cent borrow from financial resources. The 70 per cent of the adult population either unbanked or underbanked. This translates to opportunity – especially for fintech startups.

Push for Branchless Banks in Southeast Asia

Digital or branchless banks, known as Neobanks, are disrupting consumer finance. Globally, they re challenging the traditional banks which rely on heavy bricks and mortar presence with slick mobile-based financial services. Southeast Asia (SEA) has emerged as keenly-contested battleground amongst new startups.

Driven by two key trends, firstly SEA has a huge underbanked population ready to be taken up by the winner. At the moment, only a quarter of adults have full access to financial services, leaving almost 300 millions adults in the region either underbanked or completely unbanked. This results in huge potential for growth in the internet economy sector, particularly amongst the underbanked population where individuals may not own a bank account and have no access to further financial services.

Secondly, there is huge internet-savvy population – in increase of 100 million users since 2015. Introduction of cheap smartphones and improved internet connectivity have accelerate the mobile-first experience. To say, the region’s young demographic have been champions to push this. With a further 150 million Southeast Asians predicted to turn 15 over the next 15 years, now is the ideal opportunity to onboard this young population to fuel SouthEast Asia’s internet economy.

Neobanks serving the unbanked communities around Southeast Asia

TONIK

The first digital-only neobank in the Philippines, TONIK, is on mission to revolutionise the way money works. A two-year-old startup which received a bank license in the Philippines.

Tonik is led by Founder & CEO Greg Krasnov, who had previously incubated four fintech start-ups in the consumer finance space in Asia, as well as founded, built and successfully exited a significant consumer finance bank in emerging Europe. In the company’s estimates, Philippines represents a US$140 billion retail savings market, and a US$100 billion unsecured consumer lending opportunity. Founded in 2018, tonik is launching operationally in 2020 in the Philippines on the basis of its own bank license, with support and R&D functions based in Singapore and Chennai, India.

TIMO

Timo is the first Digital bank in Vietnam, operating since January 0216 Through a partnership with local bank VP bank, TIMO provides comprehensive set of tools supporting their financial needs with banking service essentials. Users can manage their bank accounts easily and conveniently through the Timo mobile app or send money to friends just by using the phone number.

First launched in Ho Chi Minh City in early 2016, Timo expanded to Hanoi later that year. In March 2017, Timo began offering insurance products through a partnership with Sun Life Vietnam. Timo, which stands for “time is money” – has a fast-growing client base, highlighting the appetite of Vietnam’s millennial generation for all things mobile.

ASPIRE

Reinvent banking for small businesses. Headquartered in Singapore, Aspire is a Y-Combinator backed technology organization that serves small businesses with convenient & inclusive financial services across Southeast Asia. An Aspire Business Account is opened online with a few easy steps and gives customers access to a large variety of services. We built Aspire from the ground with one thing in mind – serve small business owners with speed and simplicity. No long waits, paperwork, or hidden fees like other financial institutions – so business owners could concentrate on growing their businesses.

Aspire provides small business owners and entrepreneurs in Southeast Asia with the financial tools to solve their cashflow management and working capital needs. Aspire believes that if they can empower business owners to be successful they can go on to make an impact to the communities they are part of.

Consumer finance and business banking for small-and medium-sized businesses are growth areas for neobanks. The sector is still under-developed and customers are poorly served. This just the beginning for neobanks. We’re expecting to see a lot more changes.