Every day on 31 October, countries around the world celebrate World Savings Day. This is observed to promote the importance of savings for the country’s economy and the individuals alike.

The World Savings Day has been established almost one century ago to inform people all around the world about the idea of saving their money in a bank rather than keeping it under their mattress. This year theme is when you save a bit, big things follow !

History of World Savings Day

World Savings Day was first introduced on 30 October 1924 to encourage the importance of bank savings and restore people’s confidence in banks. It was established during the 1st International Savings Bank Congress (World Society of Savings Banks) In Milan, Italy.

The intention was to make the public aware of the importance of saving money mainly because people were not confident about saving anymore after the First World War. The savings banks also worked with the support of schools, offices, sports, and women’s associations to promote savings. After the Second World War, World Savings Day became popular. And from then on, World Savings Day is being celebrated in many countries

Why is World Savings Celebrated ?

There are many obstacles in savings for poor people since the rate of unemployment and poverty are high in many countries around the world. So, it’s necessary to educate people to save money as it is needed during unemployment, illness, disability or old age.

‘Saving’ is both a noun and a verb. If you want savings (the noun) you first have to make them (the verb). If you’re rich it’s not hard to make savings, because you have many tools for the job, such as automated deductions from salaries. So the rich focus on the noun – making sure that the savings they have enjoy the best mix of accessibility, security and returns. And because most of their spending is covered by their remaining regular income, they can hold their savings over the long term, dedicating them to large-scale expenditures in the future.

It’s different if you’re poor. You may not have a steady income, let alone a regular job, so you cannot delegate the making of savings to some automated procedure. You have to focus daily on the verb, struggling to squeeze money from a small and unreliable income and to find a place to keep it safe and out of reach. And because your income arrives in amounts big enough to cover only your most basic expenditure, you need to build savings not just for large-scale future needs, but also for things like clothing and schooling and visits to the doctor. Most of the sums that you build through savings are spent as soon as they are formed, rather than held for the long term. The financial lives of the poor are dominated by the need to build usefully large sums of money for immediate expenditure.

Cultivating Savings To Promote Financial Literacy and Inclusion

Access to financial services, including savings, is vital for poverty alleviation and social harmony. The ability to save and invest is an important component of poverty reduction and self-empowerment.

Over the past ten years, there has been a greater focus on developing savings products that meet the needs of the poor. More and more people understand that even the poorest save. But, reaching the poor and very poor does not happen automatically. Providers who seek to reach people at the very bottom of the poverty scale need tools to understand whether their products are actually reaching their target markets, what products and features are appropriate, and how to market effectively.

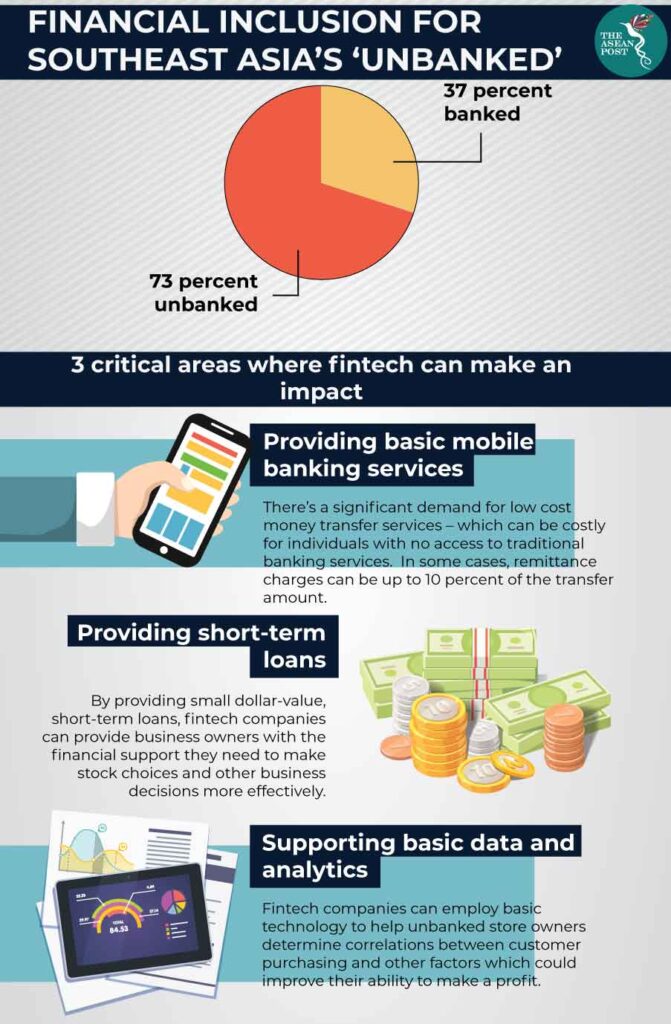

Financial access should be a basic right for each member of society. Suffice to sat that when an individual given access to digital banking services, those who were previously unbanked or underbanked would be exposed to a myriad of opportunities which will then help create a more inclusive banking ecosystem.

Simultaneously, financial education plays a major role in helping individuals to access and use formal financial products in an efficient way. In fact, financial literacy can be considered as a demand side of financial inclusion, which is very important to promote financial inclusivity.

Also Read :

There is tremendous opportunity to deliver financial services through mobile channels, especially for the unbanked and underbanked population. These three neobanks are disrupting consumer finance in Asia.