As the region’s biggest polluters are likely to see emissions rise until well into the 2030s, the Philippines is positioned to spearhead renewable generation growth in Southeast Asia.

In a surprising turn of events, the Philippines has surged ahead of its Southeast Asian neighbors to become the region’s frontrunner in planned clean-power projects. This leap forward comes as a result of fewer investment restrictions and green-minded policies that have successfully attracted both domestic and foreign capital.

RELEVANT SUSTAINABLE GOALS

Renewable Energy Roadmap

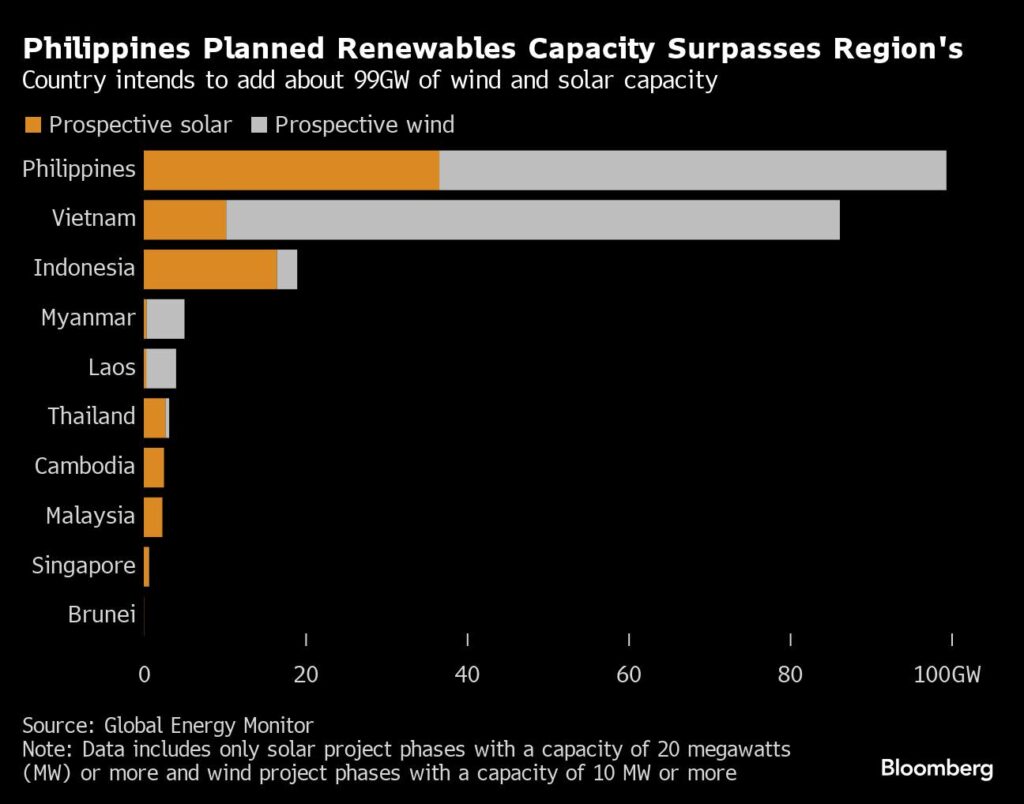

Recent changes, including allowing full foreign ownership of renewable energy projects, have helped secure an impressive pipeline of 99 gigawatts of wind and solar developments. This figure not only surpasses the power needs of all Philippine households but also outstrips Vietnam’s 86 gigawatts and is approximately five times higher than Indonesia’s planned projects.

While only 3 percent of the Philippines’ ambitious renewables pipeline is currently under construction, it represents a significant step toward meeting the country’s goal of increasing the share of renewables in its electricity mix to more than a third by the end of the decade, up from about a fifth currently.

At a recent clean energy forum in Manila, companies like Oslo-based Scatec ASA expressed enthusiasm about the Philippines’ potential, especially in contrast to neighboring countries where funding and regulatory issues have hindered progress. Scatec’s CEO, Terje Pilskog, noted, “In many of the other markets, there are still regulatory challenges. But in the Philippines we see lots of opportunities to continue to grow.”

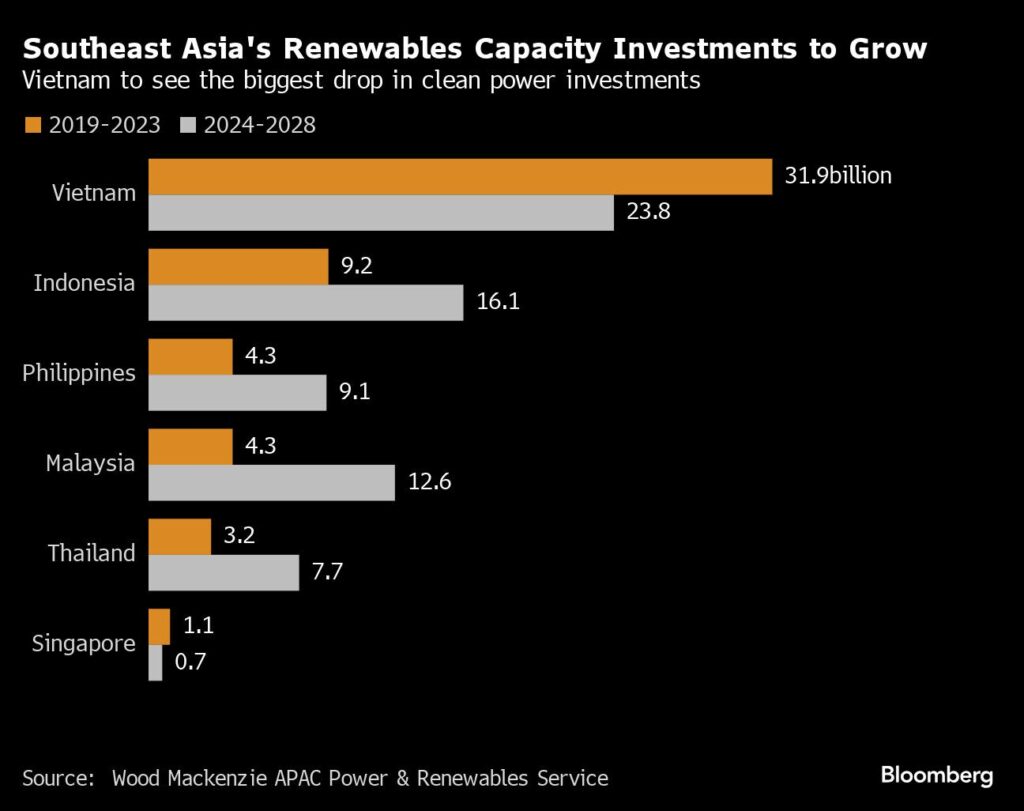

The Philippines’ success can be attributed to a series of policy moves by successive governments. These include releasing an offshore wind development strategy, offering tariff and tax incentives, and opening the renewables sector to full foreign ownership. As a result, clean energy investment jumped 41 percent to $1.3 billion in 2022 from the previous year, according to BloombergNEF.

Private Sector Involvement

Unlike many of its neighbors where state-owned entities dominate power markets, the Philippines allows private firms to participate in the generation and sale of electricity. This openness to private sector involvement has fostered innovation and attracted investment.

However, challenges remain. To truly accelerate its energy transition, the Philippines must overcome obstacles such as extending transmission lines across its archipelago of more than 7,000 islands, expanding grid capacity, boosting storage, and streamlining the land permitting process.

Despite these hurdles, the policy certainty in the Philippines has helped the country “leapfrog” over regional peers, according to Ramesh Subramaniam, director general at the Asian Development Bank. This progress is particularly notable given the struggles faced by Vietnam and Indonesia in implementing their G7 Just Energy Transition Partnership deals.

As the region’s biggest polluters are likely to see emissions rise until well into the 2030s, the Philippines is positioned to spearhead renewable generation growth in Southeast Asia. However, success is far from guaranteed. As Ramnath Iyer from the Institute for Energy Economics and Financial Analysis notes, “The auctions have been done, projects have been awarded. Now the work has got to be done.”

You may also be interested in :

Philippines’ $165 Billion Renewable Energy Revolution : Navigating The Transition With JETP Funding