UN rules governing bilateral carbon offsetting between governments have yet to be agreed but deals are being done, raising concerns about integrity

At the Cop28 climate summit in December, Santiago Peña, president of the densely forested South American nation of Paraguay, struck a deal with Singapore’s Senior Minister Teo Chee Hean to directly supply the Asian country with carbon offsets to help reduce its emissions.

Both governments announced several carbon offsetting deals at Cop28 in Dubai under the umbrella of the Paris Agreement’s bilateral carbon trading principles.

But the rules for how to implement them have yet to be agreed, as negotiations at Cop28 collapsed over discussions on how to ensure the integrity of carbon credits. Still, that hasn’t stopped deals such as Paraguay’s moving forward without clear guidelines.

Climate experts and organisations fear the lax rules approved by the Paraguayan government – as well as its proximity to industry players – risk the new UN mechanism repeating problems that have beset the voluntary carbon market, where companies have frequently ended up buying junk offsets.

Fossil fuel firms seek UN carbon market cash for old gas plants

Despite such concerns, Paraguay has made carbon markets a top priority, even rushing to pass a new law in less than one month – between September and October 2023. The law created a national registry and a set of rules for every carbon project in the country.

It “will contribute enormously to the growth and development of the country”, said Minister of Environment Rolando de Barros Barreto, in an official statement the day the law was signed by President Peña.

De Barros Barreto was heavily involved in lobbying for the legislation to pass through Congress without modifications. “We are one of the few countries that have a tool like this,” he added in the statement.

A man fishes near chimneys giving off emissions in an industrial area of Singapore, January 5, 2016. (Photo/Reuters/Tim Wimborne

Carbon shopping

Pressed by a hike in Singapore’s domestic carbon tax – which will rise from about $3 per tonne to $18 in 2024 – its government went shopping for carbon offsets at Cop28 to offer big emitters back home. It held talks with Bhutan, Papua New Guinea and Paraguay as potential suppliers.

Paraguay – which, according to industry minister Javier Giménez García de Zúñiga, was seeking to position itself as the “lung market” of the world – landed an ideal customer.

Both countries agreed to create a bilateral commission to pick carbon-cutting projects in Paraguay. Companies based in Singapore could purchase credits from these projects in exchange for a discount on the new carbon tax rates. No official document on the deal has yet been disclosed.

“What was agreed is to create a road connecting the two countries to manage the transfer of carbon credits,” Giménez García de Zúñiga said in a statement published jointly by the two countries to mark the deal.

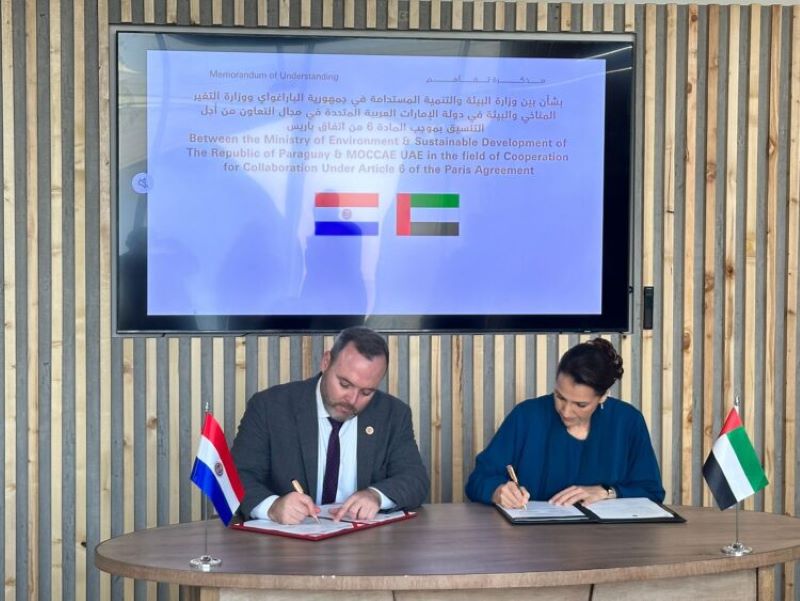

On the same day, President Peña also signed a memorandum of understanding with Cop28 host United Arab Emirates, which had embarked on its own controversial spending spree for carbon offsets, mainly in the form of agreements with African countries.

At COP28 in Dubai, Paraguay’s Minister Rolando de Barros Barreto and the UAE’s Mariam Almheiri sign a Memorandum of Understanding on carbon credits. (Photo: Paraguayan Presidency)

Rushed rules

In order to arrive at Cop28 as a reliable supplier of carbon offsets, the Paraguayan government rushed its law regulating carbon markets through both chambers of Congress in less than a month.

The initiative was marketed abroad by President Peña as “one of the most advanced laws in the world” and as a way to attract foreign investment. But it also has been heavily criticised by opposition lawmakers, academics, Indigenous peoples and environmental groups.

The new law passed without including safeguards to guarantee environmental and human rights based on an international standard that seeks “to mitigate the negative impacts of projects and, above all, to defend the rights of the people”, explained Mirta Pereira, a Paraguayan lawyer and advisor for the Federation for the Self-determination of Indigenous Peoples (FAPI).

Alberto Núñez, an activist from the Youth Network for Climate Action Paraguay, said in a public hearing prior to the bill’s approval that “without explicit human rights safeguards, this (law) will have a climate-friendly name but will be destructive”.

Opposition senators said it had been influenced by peddling to favour law firms that advise on carbon projects.

A proposal to create mechanisms for handling complaints, information requests and potential land conflicts was also rejected by Peña’s ruling bloc of lawmakers.

Protected forests

Another issue is that the new law allows for carbon projects to be set up within national parks and forest reserves, in an effort to finance the country’s protected areas, experts said.

But the forests in the concession areas would have already been protected without funding from the offsetting projects, which means their credits lack “additionality” in terms of emissions reductions, according to the standards recommended by the Integrity Council for the Voluntary Carbon Market (ICVCM), an independent body that seeks to raise the quality of carbon credits for trading.

Inigo Wyburd, a researcher at non-profit organisation Carbon Market Watch, said “additionality is necessary” for Paraguay’s market to be credible. “It is important that it is reflected in the text of the law. Areas that are not at risk of being deforested should not be eligible to receive carbon credits,” he added.

Without such safeguards, carbon schemes – including the country’s bilateral offsetting deals – risk repeating the errors of the voluntary market, according to Carbon Market Watch policy analyst Jonathan Crook.

Forest projects whose offsets are traded in the voluntary market have been widely criticised for over-crediting emissions reductions, as well as struggling to monitor forest loss. In some cases, projects have also led to human rights violations, especially against Indigenous peoples.

Industry brokers in the room

In September, a few months before Singapore and Paraguay announced their deal, the two governments held a meeting in New York, attended by big carbon brokers likely to benefit from the agreement.

They included Singaporean commodities giant Trafigura Group, which is one of the world’s largest carbon traders and Paraguay’s biggest fossil fuel supplier.

Peña also met in New York with Per Olofsson, CEO of Paracel, a forestry company seeking to sell carbon credits from eucalyptus tree plantations in Paraguay, where Olofsson had joined meetings lobbying in favour of the new carbon markets bill.

Photograph of Paraguayan President Santiago Peña at a meeting in New York on September 20, 2023. The photograph shows Per Oloffson, CEO of Paracel, and Benjamin Chia, Singapore’s main carbon markets negotiator (second and second to last on the right, respectively). Chia’s attendance was not announced. (Photo: Paraguay Presidency)

Both Paracel and Trafigura have faced questions over the integrity of their carbon credits and had projects suspended by carbon credit verification agency Verra.

Trafigura faced problems in June 2023, when Verra launched an investigation into its Southern Cardamom project in Cambodia, after human rights groups raised concerns about land conflicts with Indigenous people.

Trafigura, which had already committed the credits to corporate buyers, had to suspend them. The results of the investigation have not yet been revealed.

Meanwhile, Paracel was also questioned last year by Verra, which suspended one of its projects aiming to generate ca

Read More