Setting finance goals without the revenues and systems to deliver on them is a recipe for disappointment – this year it must be different.

Can anyone remember a time when we didn’t start the year thinking that this time climate finance was key? Yet there is something historic and different this year. What’s on the table is a perfect combination for things to go really right or really wrong.

Last year ended with a historic outcome. After more than 30 years, the UN climate negotiations finally identified the core driver of the crisis – fossil fuels – and set out a series of steps to phase them out, which will require significant investment.

How significant? The high-level expert group on climate finance estimates that developing countries (excluding China) need $2.4 trillion annually in climate investment by 2030. Not an easy feat.

Renewables are the cheapest form of electricity generation in the majority of countries. They are projected to become even more affordable, as technology advancements and economies of scale drive down costs.

Witness bribing minister’s family own Congolese carbon credit company

They also offer greater price stability since they don’t rely on fuel purchases. However, the upfront capital investment needed is often higher than for fossil power plants. For many countries where market interest rates exceed 10 percent, this puts clean energy ambitions out of reach.

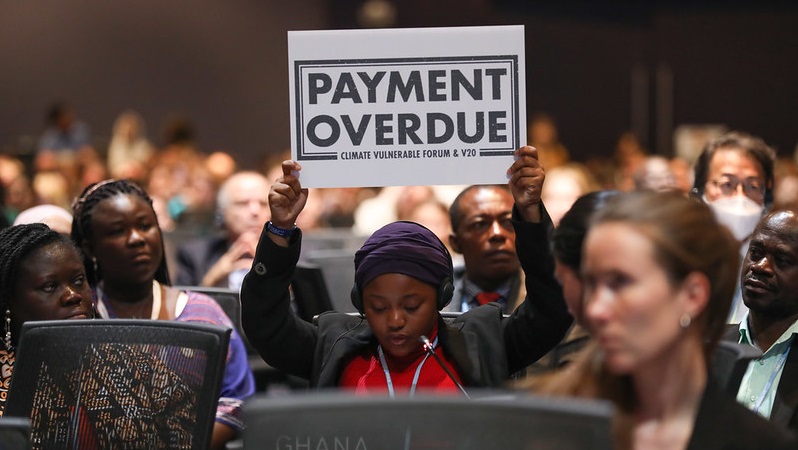

On top of this, mounting climate impacts are hitting the poorest and most vulnerable communities around the world. The cruel injustice of the climate crisis is that those who did the least to cause the problem are hit first and worst by its impacts, and have the least capacity to invest in their resilience.

New finance foundations

We know what needs to be delivered at Cop29 in Azerbaijan: all the way back in 2015 governments agreed to set a new climate finance goal, beyond the existing $100 billion per year target, before 2025.

But there are three foundations governments need to lay this year that can actually make an ambitious goal achievable: reforming multilateral development banks, addressing debt, and initiating innovative taxation.

Let’s start with the oldest of the multilateral development banks (MDBs). The World Bank turns 80 this year and is notorious for its overbearing and cumbersome bureaucracy.

Germany and US warn Brazil against using Amazon Fund to pave rainforest road

MDBs were created to provide financing to countries on more favourable terms than the market to invest in development, but have grown long in the tooth.

The ideas for what needs to change are all there: fully aligning with the Paris Agreement’s goals by ending financing for fossil fuels; reforming their blunt eligibility rules to allow middle-income countries to access cheaper financing for climate projects; and raising more capital through both conventional—government contributions and bond issuances—and unconventional means, such as rechanneling IMF Special Drawing Rights.

Debt debates

On debt, governments have finally recognised the link between countries’ fiscal space and their ability to undertake climate action, and emphasised the importance of low-cost financing to address this. The pandemic has turbocharged a sovereign debt crisis that was already brewing before 2020. The IMF has warned that 60 percent of low-income countries and 25 percent of emerging markets are in or near debt distress.

Underlying these countries’ fiscal situations are the fingerprints of climate change. Many developing countries face a climate investment trap: existing debts and high interest rates make it costly to borrow to invest in climate mitigation and adaptation.

As a result, they are more vulnerable when disasters hit, meaning higher recovery costs and a hit to credit ratings, making future investments even more expensive.

The United Nations Environment Programme estimates that climate change has raised average borrowing costs for vulnerable countries by 117 basis points, equating to an extra $40 billion in interest payments over the past decade. Countries need a way to break out of the climate investment trap if the world is to meet its cl

Read More