New carbon credit guidelines do not recommend a mandatory levy to fund adaptation despite calls from vulnerable countries and experts

The carbon credit industry has successfully fought off a push by some of the most climate vulnerable nations to place a mandatory levy on carbon offsets to fund climate change adaptation measures.

The alliance of small island developing states (Aosis) wanted new guidelines on carbon credits to recommend that a mandatory 5% levy on carbon credit revenues. The money would go to the Adaptation Fund to finance projects like seawalls to protect against rising sea levels.

This idea was supported by the expert panel of the Integrity Council on the Voluntary Carbon Market (ICVCM), the organisation drawing up the guidelines for the industry.

But, with sellers like the NGO Conservation International and buyers like the Spanish bank BBVA opposed, the ICVCM’s board decided to make the 5% levy optional.

Adao Soares Barbosa, a climate negotiator for the south-east Asian island nation of Timor-Leste, told Climate Home that “mandatory measures would be good”, because if it is optional then “it might not be fulfilled”.

But both he and Guinea’s climate negotiator Alpha Kaloga said they were pleased that a 5% levy was there, even if it is optional. “I believe that this principle will become the rule in the near future,” said Kaloga.

Revealed: How Shell cashed in on dubious carbon offsets from Chinese rice paddies

In 2022, the UN estimated that funds for climate change adaptation in developing countries were five to ten times lower than needed. By 2030, the finance needed for adaptation would reach between $160 and $340 billion.

But in 2020, rich countries provided just $29 billion and only aim to provide $40 billion by 2025.

At the last UN climate negotiations in Egypt, countries agreed to “urgently and significantly” scale up finance from developed countries for adaptation measures in developing nations.

Experts overruled

Pedro Martins Barata leads the Environmental Defence Fund’s work on carbon credits and co-chairs the ICVCM’s expert panel. He said most of the panel had supported making it mandatory but the board decided not to heed their advice.

“It was a political decision by the board”, said another expert panel member Lambert Schneider from the Institute for Applied Ecology. Barata said not all of the board’s members supported their decision.

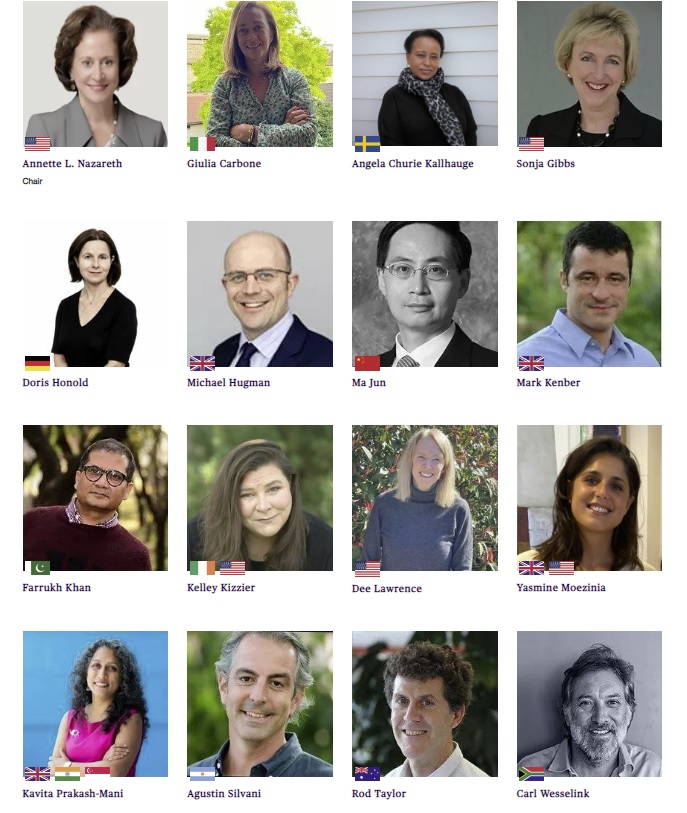

The governing board of the ICVCM

Barata said that, although the funds raised would be limited, a mandatory levy would be important symbolically. He added it would also help carbon markets become popular in communities like Pacific islands or the world’s poorest countries, where emissions are low that there aren’t going to be many carbon-cutting credit projects.

The counter-argument, he said, is that a mandatory levy adds extra costs to carbon offsets and will therefore mean less carbon-cutting projects and more emissions.

Among those making this argument in the consultation over the new guidelines was the American non-profit Conservation International, whose board includes celebrities like actor Harrison Ford and business figures like Walmart’s Rob Walton.

An unnamed employee of Conservation International argued that a levy would be an “undue additional financial burden”.

Cyclone Freddy prompts pleas for urgency on loss and damage finance

‘Reverse carbon tax’

Emergent, an intermediary that develops forest carbon credit projects, said that a levy would “constitute a reverse carbon tax on jurisdictions/projects in those developing countries that the fund is meant to benefit”.

An anonymous staff member of the Spanish bank BBVA argued that, because c

Read More