In March, Climate Impact Partners, a long-standing carbon project developer, signed a 30-year offtake agreement with Microsoft to deliver 1.5 million carbon removal credits from its Panna project, a community-led forest restoration effort in Madhya Pradesh, India. The project’s finance structure looks a lot like a wind farm, said Climate Impact Partners CEO Sheri Hickok, who previously led General Electric’s international windfarm development.

Hickok thinks borrowing lessons from renewable energy’s rapid growth could accelerate the expansion of carbon removal projects. Both incur the majority of their lifetime costs upfront, during project development, and repay that investment over years. Purchase contracts for both typically span decades and often lock in fixed pricing.

These long-term offtakes derisk the upfront investment, establishing the price certainty necessary for investors to finance project development with confidence, and simultaneously secure buyers access to the renewable energy or carbon credits necessary to meet future climate commitments.

“Corporates know how to do [virtual power purchase agreements] in renewable energy,” said Hickok. “We do [carbon purchase agreements] in carbon.” The similarity could give companies confidence in signing long-term carbon offtake agreements because it’s a structure they’ve seen before.

12 million new trees

The Panna project will restore nearly 50,000 acres of cropland and community lands in central India. The community will plant nearly 12 million native and fruit trees, drawing 3 million tons of carbon dioxide out of the atmosphere over the project’s lifespan. Microsoft has already claimed half of these carbon credits; Climate Impact Partners will sell the remaining half to other buyers. It’s Microsoft’s largest carbon removal purchase in the Asia Pacific region to date, and first in India.

Terra Natural Capital, an environmental commodities investment company, is providing the project finance in stages, based on milestones that include planting rates and community engagement.

The project’s robust pilot, experienced team and demand commitment from Microsoft made it stand out as a strong investment, said Terra Natural Capital Managing Director Erica Vertefeuille. In addition, Kita, a carbon credit insurance company, is insuring the Panna project against under- and non-delivery, reassuring investors.

Learn from renewable energy’s success

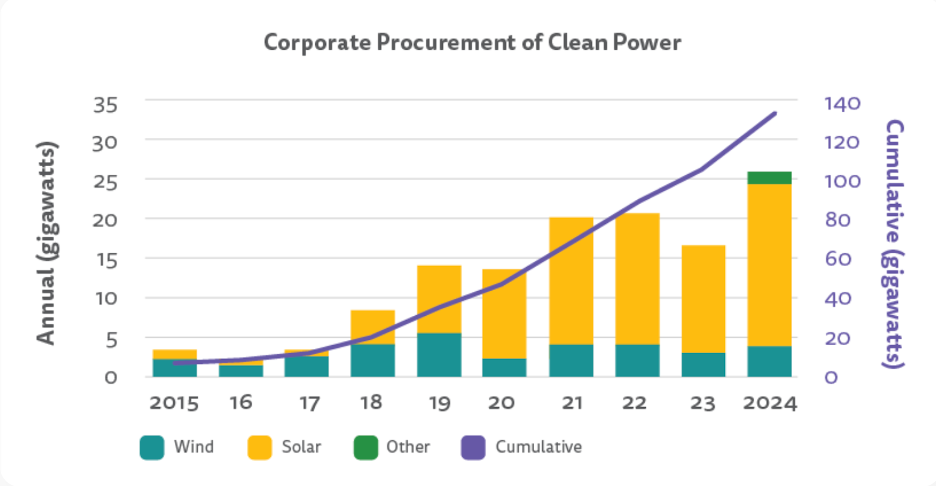

The rapid expansion and declining costs of renewable energy provide a roadmap for other climate technology deployment at scale. Two ingredients have underpinned the renewable energy boom over the past three decades, according to a 2024 report from Terra Natural Capital:

- Government policies, such as subsidies and tax credits, spurred demand and reduced risk.

- Corporate demand signals provided long-term price certainty.

These factors made renewable energy project returns more predictable, opening the door for financial institutions to invest and get projects off the ground. And with the growing field experience, technology costs have steadily declined, making renewable energy a more attractive investment to buyers and creating a positive feedback loop, leading to a steady increase in deployments.

Source: The Business Council for Sustainable Energy, here

Carbon removal can follow a similar path. “Carbon pricing is serving the same role as government policy did for renewable energy,” said Hickok, with long-term offtakes such as Microsoft’s contract with the Panna project providing the price certa

Read More