The Asia Investor Group on Climate Change (AIGCC) published findings in April showing that although 70 percent of Asian investors publicly acknowledge climate change’s impact, only 28 percent have established climate action plans aligned with international targets.

In a stark revelation of the gap between awareness and action, a recent report highlights that while Asian investors increasingly recognize climate change as a material risk, few have implemented concrete plans to address it. The Asia Investor Group on Climate Change (AIGCC) published findings in April showing that although 70 percent of Asian investors publicly acknowledge climate change’s impact, only 28 percent have established climate action plans aligned with international targets.

RELEVANT SUSTAINABLE GOALS

This discrepancy comes amid visible climate effects in the region, such as extreme heat waves forcing school closures in the Philippines, India, and Bangladesh earlier this year. The report underscores the urgent need for businesses to transition to more sustainable economic models through credible climate transition plans.

Climate Transition Plan Disclosure Remains Elusive for Most Companies

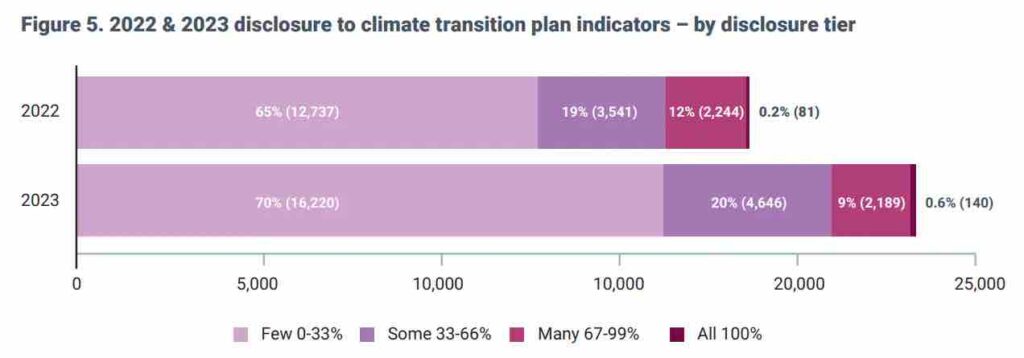

In a troubling revelation, recent statistics from the Carbon Disclosure Project (CDP) highlight the stark inadequacy of corporate disclosures in relation to climate transition plans. As of June, a mere 0.6 percent of companies have fully disclosed data corresponding to all the key indicators of a credible climate transition plan. This marginally improved figure underscores a persistent shortfall in corporate environmental transparency.

CDP, widely regarded as the gold standard for environmental reporting, released these findings in its latest report. The data show a slight increase from 2022, when even fewer companies met the comprehensive disclosure criteria. Despite this modest progress, the vast majority of companies continue to fall short of the required standards.

Moreover, the report reveals an alarming trend: the proportion of companies that disclosed data for only a minimal set of indicators—the lowest tier of compliance—rose sharply. In 2023, 70 percent of companies disclosed minimal data, up from 60 percent in the previous year. This increase highlights a growing trend of superficial compliance rather than a genuine commitment to transparency and environmental responsibility.

Investors Demand Net Zero Transition Plans, But Challenges Persist

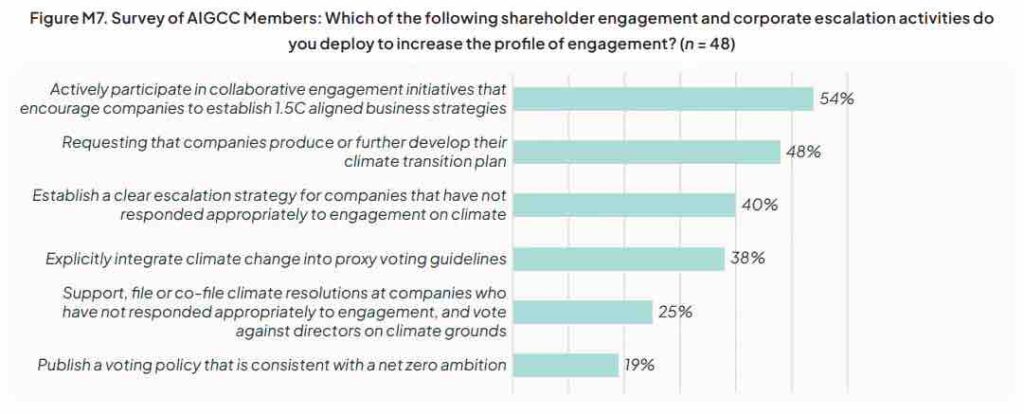

According to a report by the Asia Investor Group on Climate Change (AIGCC), 48 percent of investors are pushing for companies to produce or enhance their climate transition plans. These plans are crucial, as noted by Chaudhury, for reassuring investors and stakeholders that companies have a robust strategy to remain relevant and profitable amid the shift to a net-zero economy.

Despite this demand, widespread adoption of climate transition plans among businesses faces significant hurdles. A survey by global consultancy KPMG revealed that about a third of firms struggle to balance profitable growth with decarbonisation targets when considering a climate transition plan.

Adapting business models to align with the latest climate science often requires extensive changes to established operations and adjustments across the entire value chain, which can incur additional costs. These costs, known as “transition risks,” stem from policy actions, technological advancements, or market changes driving the shift to a low-carbon economy.

The challenges are further compounded by the combination of increased carbon pricing, the transition costs of adopting greener technologies, and uncertain market signals, making it difficult for many businesses to make definitive decisions.

However, Dickinson emphasized that “investments delivering long-term benefits are not costs” if businesses understand the trends of digitisation and decarbonisation, which are reshaping how economies produce and consume energy.

Chaudhury echoed this sentiment, warning that companies failing to integrate climate considerations into their long-term strategies are more susceptible to transition risks such as regulatory changes and the physical impacts of climate change. This vulnerability could lead to higher operational costs and a loss of competitive advantage, ultimately eroding shareholder value.

Additionally, businesses lacking credible climate action plans may face reduced access to capital and higher borrowing costs, as investors seek to minimize exposure to sustainability and reputational risks, Chaudhury added.

Achieving net zero by 2050 will “require a collective effort from multiple stakeholders, and the climate ambitions of businesses must be complemented by robust engagement with the wider ecosystem,” according to AIA’s climate transition plan.

The report further highlighted that “comprehensive national and private sector commitments to the Paris Agreement, holistic decarbonisation roadmaps, and greater regulatory push for environmental disclosures are among many necessary measures needed to achieve climate transition targets.”

Chaudhury noted, “We have mutual dependencies on other stakeholders, so we foresee several external developments that must occur for us to achieve our targets. We need the availability of comparable, consistent, and accurate climate data as well.”

You may also be interested in :

The $100 Billion Climate Finance Gap: Broken Promises Imperil Global Action