2023’s third quarter disrupted the trend of slowing investment in the climate tech sector. A total of $16.6 billion was invested in Q3, according to a recently released BloombergNEF analysis, due largely to interest in decarbonization and low-carbon startups. According to the report, this is the highest quarterly funding in climate tech since Q4 of 2021.

Total climate tech funding in the first half of 2023 peaked at $13.1 billion, a full 40 percent less than the same time period in 2022, according to CTVC. This dip worried the venture community, with multiple media outlets covering the once impenetrable sector’s apparent fall from grace.

But the catalyst for climate tech’s rocky start to 2023 doesn’t appear to be climate tech-related.

“I think it’s a function of the broader macro environment,” said Shayle Kann, a partner at Energy Impact Partners, to GreenBiz, “Investment is down across the board, everywhere.” Kann cites high interest rates and a challenging domestic economic situation as leading factors, and he’s not alone in his assessment.

During a recent keynote address at GreenBiz’s VERGE23, Sophie Purdom, co-founder of CTVC and managing partner at Planateer Capital, referenced a “non-zero interest phenomenon” as a reason for climate tech funding deals falling through.

Both Kann and Purdom are referring to the Federal Reserve’s decision to drop interest rates down to zero during the height of the COVID-19 pandemic. The Fed’s action was a bid to stabilize a rapidly declining economy by incentivizing the marketplace to spend and grow with minimized risk. Since then the central bank has aggressively raised interest rates to curb sharply rising inflation. Now, almost 4 years on from the initial interest rate cut and many rate hikes later, inflation has settled to 5.33 percent and no further increases are on the horizon.

In the “world of tech coming back to reality,” climate tech investing has remained relatively strong, Kann said: “There’s only a couple of sectors that are outperforming the overall investment world, and it's basically AI and climate.”

Although the total amount invested in climate tech companies decreased in H1’23, the total number of deals in the space actually increased. A total of 633 climate tech startups raised money, compared to 586 from H1’22. Startups receiving funding for the first time increased by 34 percent from 2022.

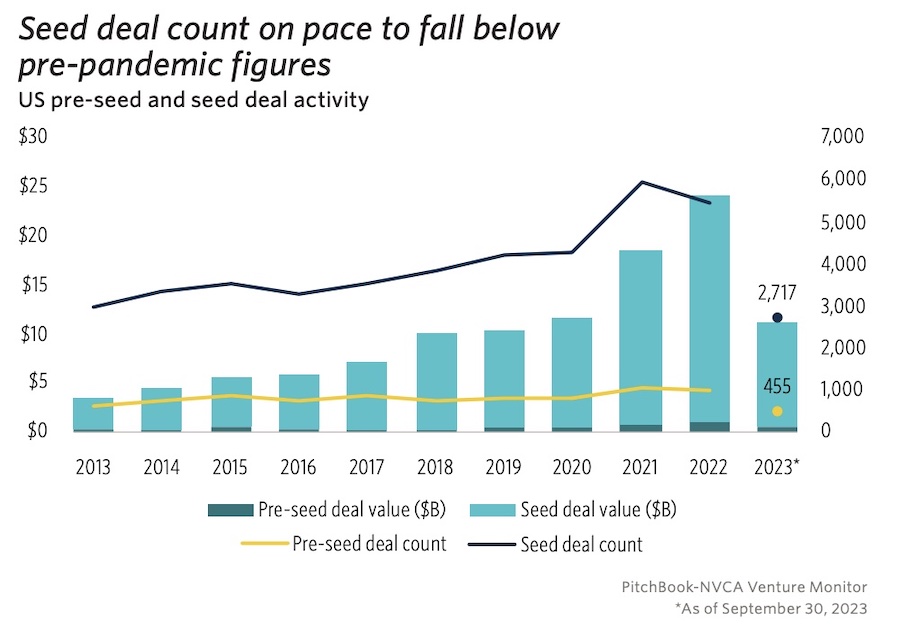

That contrasted sharply with the broader venture capital landscape. In Pitchbook’s recently released analysis of Q3 venture capital trends, early-stage activity has slumped in 2023, with a total of 2,717 deals through September.

The latest trends from Q3 show a strong rebound in terms of money flowing into the sector.

While the total number of deals fell to 241, according to BloombergNEF’s Investment Radar Q3 2023, a few massive deals secured the quarter’s financial rebound. They included H2 Green Steel’s $1.6 billion round, lithium-ion battery producer Northvolt’s $1.2 billion round, and battery recycling company Redwood Materials $1 billion Series D round. These deals all took place in sectors often connected to higher levels of emissions that are hard to abate, as noted by PWC.

The shift toward larger, mid- to later-stage deals will continue, said John MacDonagh, senior analyst at Pitchbook: “The battery spaces, [and] some of the clean fuel spaces, [like] hydrogen, for example, I think we’ll see similar trends over the next few quarters.”

CTVC’s analysis of the first half of 2023 concluded that a return to higher numbers in Q3 could indicate a marketplace recovery. With federal interest rates settling and the need for climate mitigation technology more pressing than ever, a bubble burst – like what happened to Clean tech 1.0 – isn’t a strong possibility.

“I don’t think there are any [climate tech] sectors that I would say are really falling behind,” concluded MacDonagh.

Read More