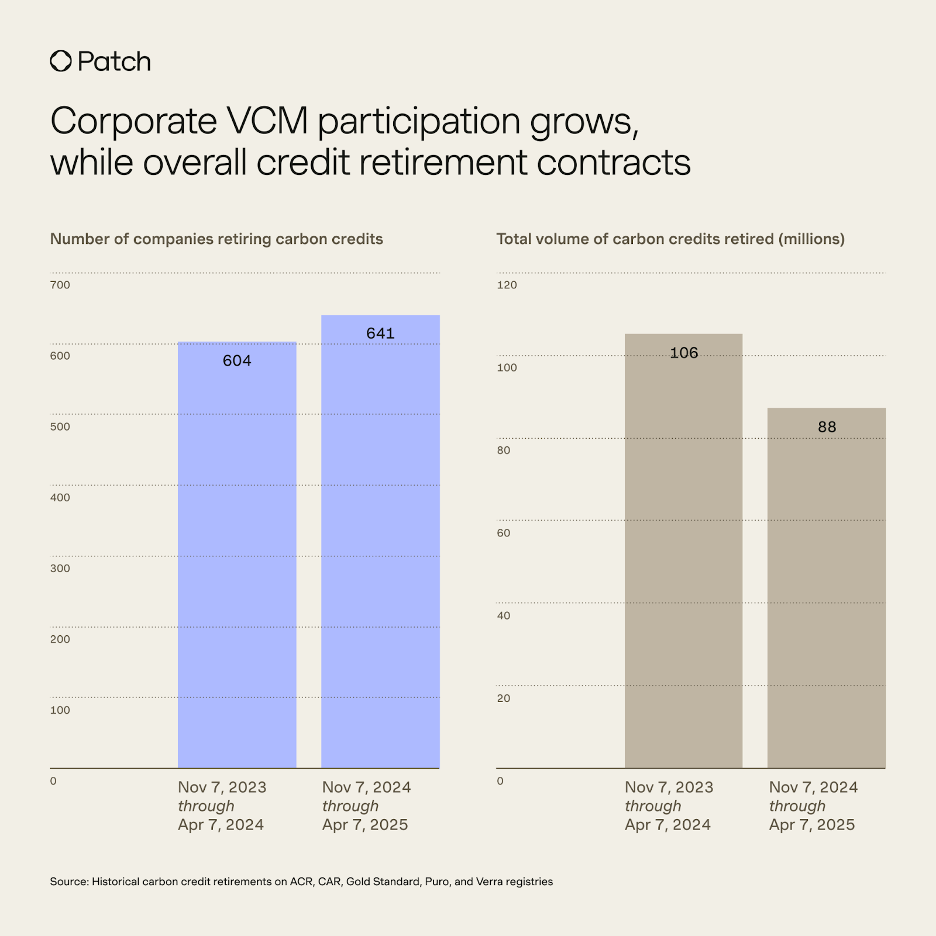

More companies retired carbon credits in the five months since the U.S. presidential election than during the same period a year ago. This indicates that carbon credit buyers are continuing to work toward their long-term climate targets, executing on strategies that stretch beyond any presidential term, according to a report published by Patch, a carbon credit purchasing platform.

While total active buyers grew, carbon credit retirement volume declined compared to the same five-month period from the end of 2023 through the first quarter of 2024. That shift may be due to recent guidance from standards setters, rather than political shifts, according to the report.

“There is no credible path to net zero without carbon removal,” said Brennan Spellacy, Patch CEO, in an interview. As a result, “we’re beginning to see folks … building up their carbon removal inventory or capacity.” That action today will set carbon buyers up to accomplish their climate targets in 2030 and beyond.

“Ramping up [carbon removal purchasing] incrementally is realistic and pragmatic,” said Louis Mark, senior manager of sustainable operations and ESG at Autodesk, which has set a 10-year, science-aligned decarbonization target to reduce its emissions and has been purchasing carbon removal and avoidance credits since 2021.

Source: Patch

Carbon market activity signals broader climate strategy

The voluntary carbon market is a “canary in the coal mine” for corporate climate action, according to the new analysis from Patch. Because credits are transferred digitally, buyers can stop purchasing at any moment, making market demand highly responsive to changes in buyer strategy.

The fact that companies are carrying on with their carbon credit strategies signals that they’re not only committed to their climate targets, but also acting on time scales that stretch beyond presidential terms. “Enterprises think in 5- or 10-year operating plans … that’s longer than any administration,” according to Spellacy.

The Patch report isn’t the first to show evidence that carbon market activity is a hallmark of companies investing more broadly in their climate strategies. Material users of carbon credits are more than twice as likely as companies not active in the voluntary carbon market to achieve other signals of credibility in their climate targets, according to a report published last fall by MSCI’s carbon markets research team.

Drivers of the decrease

Several factors are likely driving the recent dip in credit retirements.

One factor may be an overall shift away from offsetting and carbon neutral claims, according to the report.

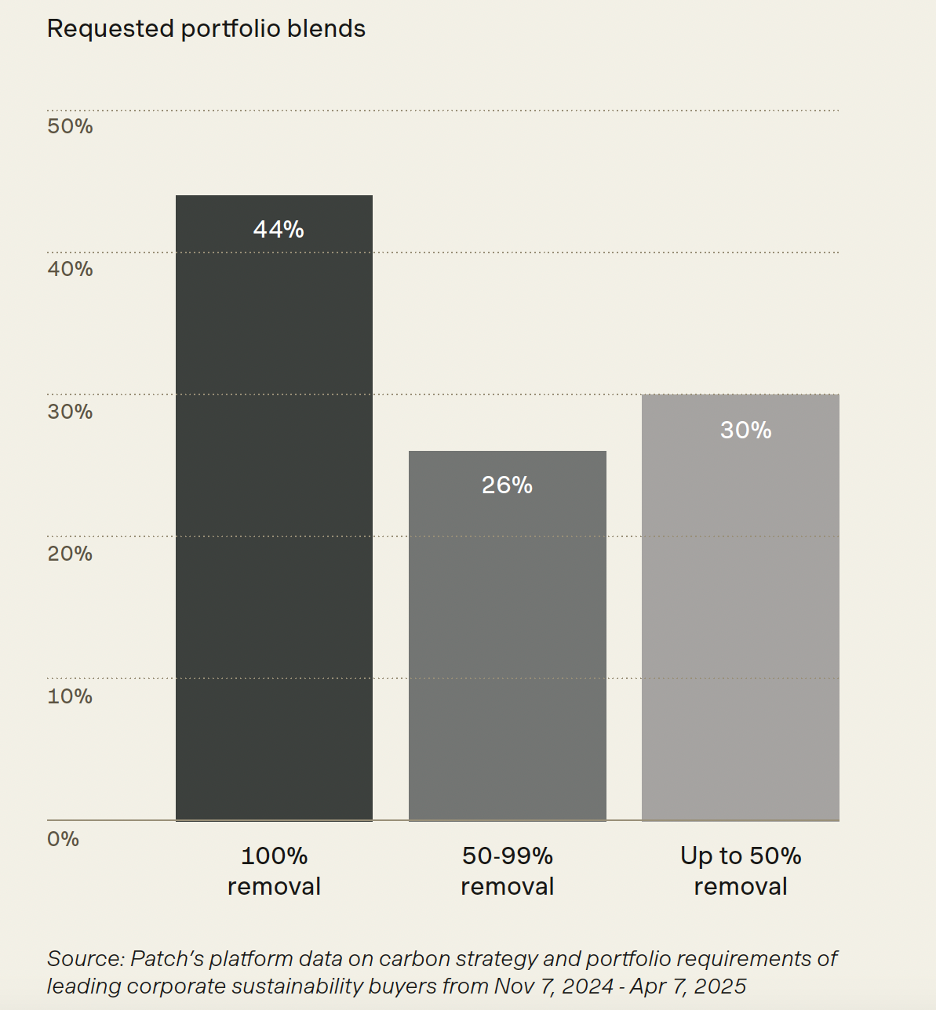

Over the past 18 months, new guidance documents from well-known standard setting bodies, including the Science Based Targets initiative (SBTi), Voluntary Carbon Market Integrity Initiative (VCMI) and The Climate Label, have advised companies to retire carbon credits as contributions to global climate action, but not to make claims about offsetting or neutralizing ongoing greenhouse gas emissions. Companies following these guidelines can focus more on opportunities for impact and less on meeting volume thresholds for their carbon credit purchases.

Another explanation of the dip is that companies active in the voluntary carbon market are gradually ramping up their carbon credit purchasing and retirements in preparation of achieving 2030 targets, rather than having to put on muscle all at once in the future.

The data also shows increasing interest in carbon offtake agreements, another sign that companies active in the voluntary carbon market today are thinking about securing credit supply for the future.

Source: Patch

Buyers are looking for removals

Carbon credits from projects that remove carbon from the atmosphere

Read More