Key takeaways

- Ideas differ on what should define “doing business in California.”

- Many companies would prefer to avoid the new requirements altogether.

- Emissions and climate risk disclosure will help spur companies to better manage risk.

In more than 240 comments on California’s new climate disclosure laws and their implementation, companies, investors, trade groups and others urged regulators to base their requirements on already widely used reporting standards.

A review by Trellis of about 100 comments, submitted in response to a request from the California Air Resources Board, showed that businesses overwhelmingly prefer that the rules follow Task Force on Climate-related Financial Disclosure (TCFD) recommendations. Many commenters specifically asked California to employ the International Sustainability Standards Board standards, which follow the Task Force guidelines and are required in the European Union’s new Corporate Sustainability Reporting Directive.

But on another major implementation question — what constitutes “doing business in California” — commenters were all over the map.

Bottom line: Most big companies are well on the way to preparing for climate risk and emissions disclosure requirements, as Europe and other jurisdictions are also soon to mandate them. But many companies would be just fine, thank you, if the California rules didn’t apply to them.

‘Avoid unnecessary burdens’

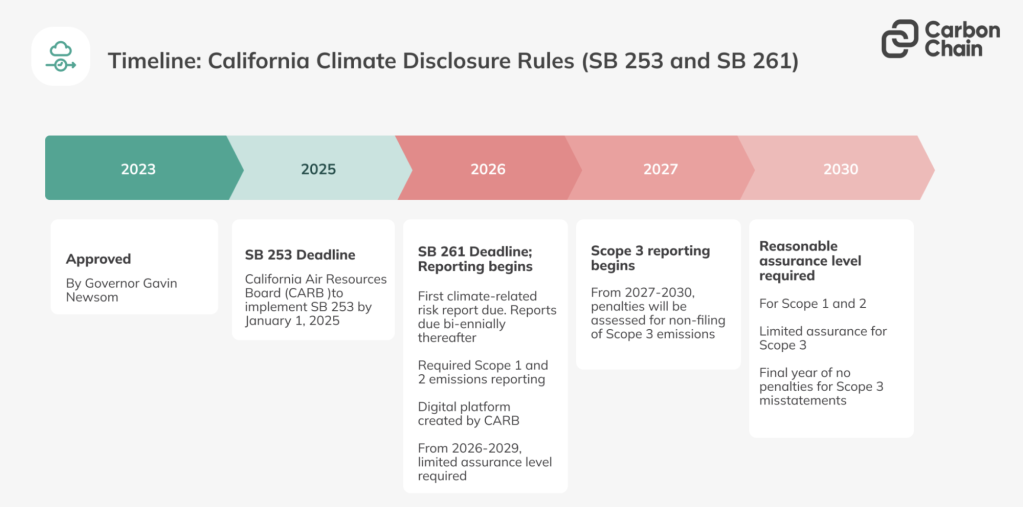

California’s Climate Corporate Data Accountability Act requires any company with annual revenues of more than $1 billion and doing business in California to annually report its Scope 1 and 2 greenhouse gas emissions starting in 2026 and Scope 3 emissions starting in 2027.

The Climate-related Financial Risk Act requires any company with more than $500 million in annual revenues and doing business in California to report climate-related financial risks and any measures it might be taking to reduce or adapt to them. Companies must start filing reports in 2026 and then every two years thereafter. Both laws require third party assurance.

The two laws were passed in 2023 and slightly amended last year. Even as the federal government abandons the idea of climate disclosure requirements, laws in California — the world’s fifth-largest economy — will affect many businesses in the U.S. and overseas.

“This ground-breaking legislation is set to reshape corporate reporting standards, with ripple effects outside California,” said the Mayer Brown law firm in guidance to companies. Since the U.S. Securities and Exchange Commission in March dropped its plans to mandate climate risk disclosures, California is the only U.S. jurisdiction requiring them, although several other states are considering similar legislation.

The California Air Resources Board asked specifically if it should mandate a strict set of standards based on the Greenhouse Gas Protocol and TCFD guidelines, and what should constitute “doing business in California.” It received an earful.

“We encourage all standard setters, wherever they are located, to set globally harmonized and aligned reporting legislation that avoids unnecessary burdens for businesses — interoperability with each other is a prerequisite,” wrote IKEA USA Public Affairs Leader Doug Murray. “A parent company reporting to EU CSRD standards should not have to disclose the same information in a different format and/or in another jurisdiction on behalf of one of their subsidiaries.”

California-based eBay, which operates everywhere, concurred. “The most important goal of CARB’s implementation should be to ensure interoperability with other reporting standards,” wrote eBay Chief Sustainability Officer Renée Morin. “EBay is already reporting climate risks and greenhouse gas (GHG) emissions voluntarily and is subject to mandatory climate reporting requirements in jurisdictions such as the European Union.”

Credit: CarbonChain

Asset managers applaud

Numerous asset managers — including Generation Investment Management, Impax Asset Management, Boston Walden Trust, Parnassus and Trillium Investment Management — recommended adoption of the Financial Reporting Standards Foundation’s International Sustainability Standards Board Standards, which also are the basis of the European rules. The asset managers also applauded California for requiring disclosure, because investors strive to assess climate-related financial risk when making decisions.

“As investors we seek consistent, reliable and comparable global reporting of climate-related risks and opportunities in

Read More