In just a few years, carbon removal has gone from a niche interest to an activity that many big companies feel compelled to invest in.

It’s easy to see why. The Intergovernmental Panel on Climate Change (IPCC) has said that gigatons of removals will be needed to contain global warming. And key standard-setters, including the Science Based Targets initiative (SBTi), have focused on removals above other types of carbon credits.

Yet purchasing removals is a daunting task. There are multiple technology options, each with its own pros and cons. Prices vary by an order of magnitude.

To help companies get started, we talked to two very different businesses — TikTok and the Japanese conglomerate Sumitomo — that are in the process of building removal portfolios. Here are three lessons for any company considering a carbon removal strategy.

Know all your priorities

Most companies plan to use removals to offset future emissions. But what else is important beyond that? It’s essential to go into the market with a clear vision.

In 2023, TikTok set a goal of going carbon neutral in its operations by 2030. The company figured it could reduce Scope 1 and 2 by 90 percent, and settled on using removals to offset what was left. In addition to a focus on high-quality credits, the company had a less-common goal when selecting credits: It wanted to have creators on its platform visit the projects and spread the word about the work.

“I would hope that we could work with some of our partners to almost demystify some of these conversations,” said Ian Gill, TikTok’s global head of sustainability. “Because it’s very easy to hear about these topics and not necessarily get why are they beneficial.” In practice, that meant creating a global portfolio so that influencers from around the world could get involved.

At Sumitomo, the decision was being made in the context of the GX-ETS, an emissions trading scheme being phased in by the Japanese government. Sumitomo wanted to buy credits both to offset its own emissions and to sell on to other companies in the trading scheme, said Micah Macfarlane, chief supply officer at Carbon Direct, a carbon management firm that worked with Sumitomo. To satisfy government rules on use of credits, Sumitomo wanted to focus on projects that are guaranteed to lock carbon away for at least 1,000 years.

Get help selecting credits

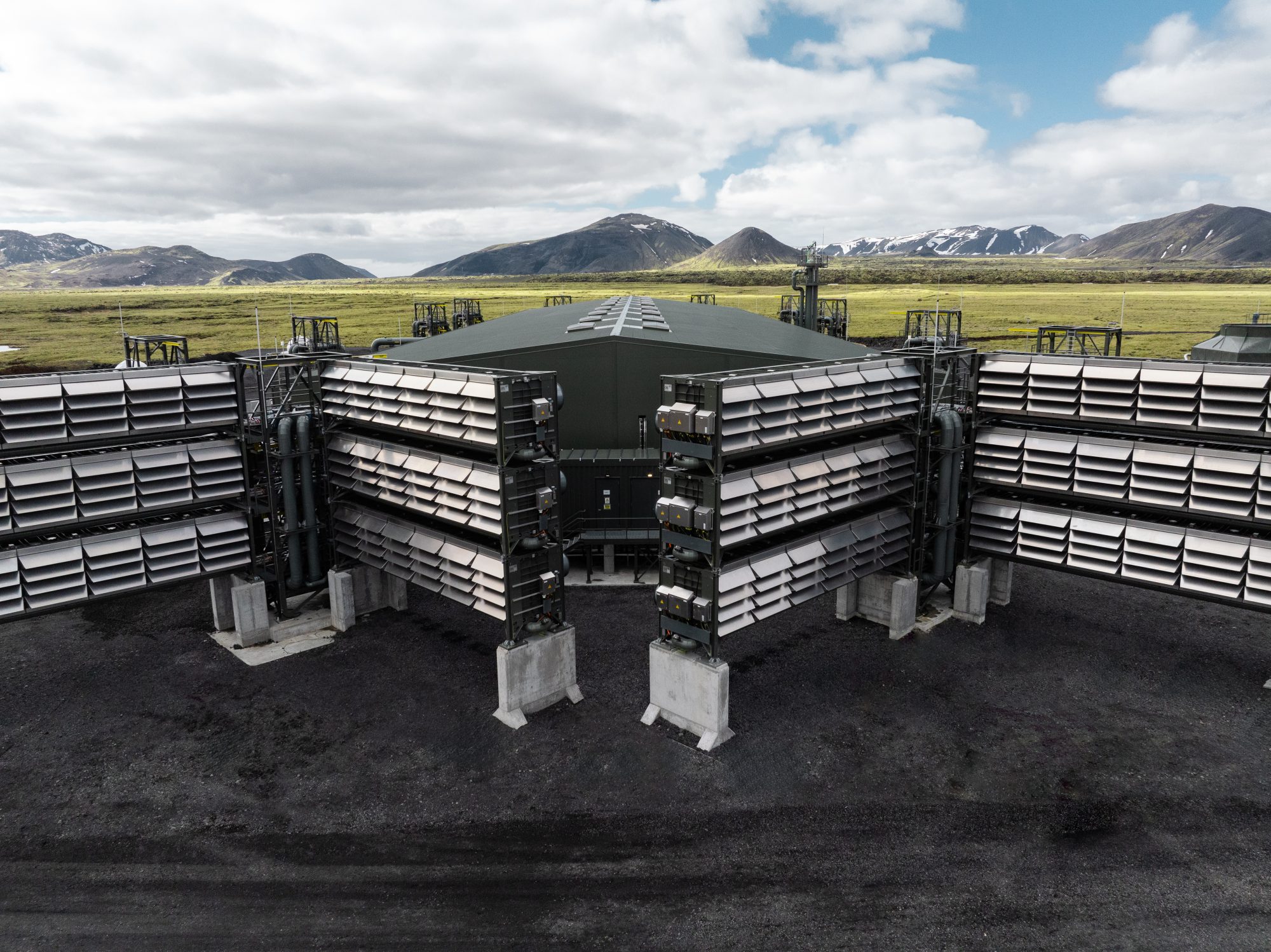

Strategy helps narrow the focus, but buyers are still left with an intimidatingly long menu of options. “Companies are typically overwhelmed by the sheer amount of technologies that exist in CDR,” said Adrian Siegrist, chief commercial officer at Climeworks, a carbon removal developer and broker that helped TikTok build its portfolio.

Only a handful of companies have the in-house expertise to sort throug

Read More